In 1944 started what was to become the greatest era of credit expansion in the history of the world. That era is now coming to an end, and the consequences will be devastating.

In July of that year, delegates from all Allied nations gathered at the Mount Washington Hotel, in Bretton Woods (New Hampshire) to regulate the international monetary order after the conclusion of World War II. It led to the establishment of the International Monetary Fund and the so-called Bretton Woods system for international financial relations.

Most importantly, the US dollar was chosen to become the new global reserve currency; the US government committed in turn to redeem its currency at 1/35th ounce of gold per dollar.

That extraordinary privilege of becoming the issuer of the global reserve currency, American governments quickly proved irresponsible with it. Power corrupts, and there is no greater economic power than controlling what other people use as money.

Before we get into that, and the American sovereign default of 1971, we need a short primer on the nature and history of money.

What Is Money?

A fisherman who needs shoes doesn’t always know a cobbler who eats fish; and even if he did, he might not need shoes right away, whereas his fish will perish fast. Therefore, he must find a way to efficiently save the fruits of his labor, and a means to exchange that labor with a counterparty.

Thus are the two functions of money: it is a store of wealth, and a medium of exchange. To function properly, that money needs to be durable, portable and divisible; it needs to exist in limited supply, or it would be worthless; and that worth needs to be fairly widely recognized.

A commodity that fails in any of these respects is unsuitable as money. Diamonds for example fail divisibility: if you cut one in half, each half is worth less than half the value of the original crystal. Similarly, tobacco can only be money in prison; its supply is otherwise not limited enough.

It turns out there is one thing that fulfills quite perfectly all of the requirements. That is, precious metals. Gold in particular is nonperishable and virtually indestructible (you could leave it under the sea for a thousand years and it will not oxidize). For that reason most of the gold ever mined is still around. Its supply is very limited; the total quantity of gold currently above ground (less than 200,000 tonnes) would fit in an Olympic swimming pool.

That is why humans, for as long as they’ve been able to produce wealth in excess of their immediate needs, have voluntarily elected gold as the superior form of money.

It is common for those who don’t understand money to state things like “you can’t eat gold” as a kind of rebuttal. But that’s precisely the point. If you could eat gold, it would not work efficiently as money, as it would not be durable. Actually, gold is almost completely useless as a commodity; it is therefore quite perfect as money.

What Is Paper Money?

There is one respect in which gold admittedly fails somewhat, especially as trade grows in volume and scope: it is not perfectly portable. Carrying it around, especially over great distances, is impractical. So gold remains unchallenged as a store of wealth, but a better medium of exchange has to be found.

Enter paper money.

Paper money is originally a receipt on gold; a title of ownership. Savers store their gold in a vault, and the vault owner issues a receipt. Anyone holding such a receipt can go to the vault and redeem it for the corresponding amount of gold.

Naturally, such receipts start being used for commerce in lieu of the metal itself. As long as the vault owner can be trusted, these pieces of paper are preferable, as they are easier to carry around. A problem arises however when the vault owner issues more paper than the corresponding gold in storage; and it is very tempting to do so. People will exchange their valuable labor against it, and even pay interest on it! Producing counterfeit receipts does not furthermore lead to immediate adverse consequences, as savers are unlikely to redeem them all at the same time; on the other hand it does allow the vault owner to become insanely rich.

As the crooked vault owner’s wealth grows, people become suspicious, and their trust erodes. An inflection point is reached when enough of them choose to redeem their receipts, only to discover there isn’t enough gold left in the vault. The vault owner is hanged, but that hardly helps in recovering their stolen wealth.

That is when the government steps in. As it usually does, it makes the problem worse. Instead of outlawing the crime, the sovereign typically gives it color of law. Such fraud is, after all, a great way to finance his pet wars. Issuing counterfeit money is a really good way to surreptitiously loot producers and savers. As long as the theft isn’t too obvious, he figures it should be OK.

Yet again, the temptation is just too great. As the king becomes an emperor, the unproductive class around him grows in tune. Unearned wealth produces complacency, decadence, obesity and hubris. Courtiers and other parasites forget about the fraudulent origin of their wealth, believe themselves to be indispensable, and so the fraud grows in breadth; more and more counterfeit money is issued, as the parasites’ gluttony becomes insatiable.

Eventually, the same inflection point is reached, trust is lost, and the fraud is revealed; only this time it happens later in the game. More time has elapsed, the imbalance has grown much bigger, and the correction is therefore much more painful. People don’t merely hang the vault owner, but the sovereign and the entire parasite class around him.

When trust in the money is lost, time has come for a violent revolution.

Seigneurage And Debasement

Looting of wealth through the control of money does not start with paper currency. True, it makes the theft more surreptitious; but when Marco Polo returned to his native Venice in 1295, and wrote about the Chinese invention of paper money, the practice of an “inflation tax” had already existed for a long time.

And actually, it was already so commonplace that it had a formal-sounding name: seigneurage.

Seigniorage, also spelled seignorage or seigneurage (from the Old French seigneuriage, “right of the lord (seigneur) to mint money”), is the difference between the value of money and the cost to produce and distribute it.

The Roman empire is a famous example. The major silver coin used for the first 220 years of the empire was the denarius; during its early days, it was of high purity, containing about 4.5 grams of pure silver. However, as the empire over-extended itself, and as the ruling class grew obese and decadent, the content of silver dropped.

By the time of Marcus Aurelius, the denarius was about only 75% silver. Caracalla tried a different method: he introduced the “double denarius”, which was worth twice as much as the denarius in face value, but contained the silver weight of 1.5 denarii. By the time of Gallienus, the coins had barely 5% silver. Each coin was a bronze core with a thin coating in silver. The shine quickly wore off to reveal the poor quality underneath.

By 265 AD, when there was only 0.5% of silver left in a denarius, prices skyrocketed 1000% across the Roman empire. Only barbarian mercenaries were to be paid in gold.

Coin debasement is both a cause and a consequence of demise. A vicious circle sets in, whereby a bloated State increases seigneurage to finance growing expenditures; this does not help increase prosperity however, it merely transfers wealth away from the people who produce it in the first place, thus hastening the demise, which in turn requires more debasement. The rest is history, and by 476 AD the Western Roman empire had ceased to exist.

Back To the 20th Century

Something very important happened on the afternoon of Friday, August 13, 1971. During a secret meeting at Camp David, a decision was made for the US to default on its gold obligations. The dollar would no longer be redeemable at 1/35th of ounce. That decision was announced on television on Sunday, August 15; the historic clip can be seen below.

Of course, this was not called a default. It was presented as a “temporary” measure, meant to be “against speculators” and for the “stability of the US dollar”. Later, the event was euphemistically called the Nixon Shock.

To be sure, the announcement did not take astute observers by surprise. The Great Society programs and Vietnam war meant the Americans were printing too many dollars, which eroded trust in the commitment made in Bretton Woods in 1944.

In November 1961 already, the United States and seven European countries agreed to cooperate by intervening in the London gold market to maintain the official price of 35 dollars per ounce; that was done essentially by dumping physical bullion into the market, and was called the “London Gold Pool”.

In February 1965, French president Charles de Gaulle publicly announced his doubts, and accused the Americans of abusing their extraordinary prerogative.

On 14 March 1968, the United States requested of the British government that the London gold markets be closed the following day to combat heavy demand for gold; on March 15, the Queen of England declared a bank holiday. On March 18, 1968, the US Congress repealed the requirement for a gold reserve to back the US currency.

The London gold market stayed subsequently closed for two weeks, while those in other countries continued trading with increasing gold prices. The events marked the collapse of the London Gold Pool.

It still took an extra 3 years for the US to publicly default on its commitment. In total, the postwar gold exchange standard had survived 27 years, the last 10 of which saw a rapidly declining trust in the soundness of American currency.

Following the default of 1971, as confidence in the US dollar was dealt a severe blow and price inflation in the USA was running rampant, the Americans managed to save their currency. In July 1974, US Treasury Secretary William Simon secretly made a deal with King Faisal bin Abdulaziz of Saudi Arabia (archive). In return for his pricing of oil and accepting payments solely in US dollars (and implicitly agreeing to re-invest much of the proceeds back into US Treasuries), the US offered military protection to the al Saud clan.

Thus was born the “oil exchange standard”, a mechanism also dubbed petrodollar recycling. In effect, the US dollar wasn’t backed by gold any longer, but by Saudi oil instead. The printing presses could continue running amok.

This website has great graphs illustrating the way life started changing for Americans in 1971. We reproduce the three most important ones below.

Despite the oil exchange standard, the dollar wasn’t out of the woods, and price inflation remained very high throughout the 1970s. Fed chairman Paul Volcker raised the federal funds rate to a peak of 20% in June 1981, which led to a severe global recession, marked a generational top in gold, and ultimately secured his country’s victory in the cold war.

Following the collapse of the Soviet Union, the USA was left as the sole and uncontested global superpower. Thanks to the extraordinary privilege obtained in 1944, it had built a large empire. Nothing and nobody could challenge the supremacy of the US dollar; gold by that point was fully demonetized in the public psyche, as people had already forgotten the importance it played not so long ago. Greenspan’s “great moderation years” rhymed with a tremendous “wealth effect”, itself a corollary of debilitating credit expansion (i.e. money printing), although it wasn’t presented as such.

This naturally leads us to the 21st century, and the year 2008 in particular, when the canary in the coal mine stopped singing.

Wealth Effect

Monetary crises are neither rare nor exceptional. The scenario is always the same: the tremendous power that lies in controlling what people use as money is abused, too much of it is put in circulation, confidence is lost, and the money is destroyed. In the 20th century alone, there are at least 56 examples of such destruction.

We may come up with fancy new terms such as “quantitative easing” instead of “debt monetization”, or “dovish monetary policy” instead of “monetary debasement”. Nothing is new under the sun, and the principles are always the same. We prefer the expression Zimbabwe School of Economics.

The pattern is that of a cascade effect. Once it has started, the process is very difficult to stop; before then, the unstable system can present the appearance of stability for a long time. That is the period during which the illusion of wealth, or wealth effect, is felt. Counterfeit credit-money is put in circulation, which is mistaken for actual savings (a cornerstone of prosperity); interest rates are thus lowered, asset bubbles are inflated, and everyone feels good.

Malinvestment is the name of that game. Prices rise, producers and savers are robbed, and everyone becomes poorer except a few parasites closest to the monetary spigot. Eventually, reality catches up as indeed the savings are not real, and the bubbles are unsustainable.

Most importantly, the exercise suffers from diminishing returns. Eventually, the credit expansion stops producing even the most marginal wealth effect. That is what central planners call a liquidity trap, and when they (seriously) start talking about helicopter money.

Indeed that’s the point: when the deflation starts, there is only one perceived antidote: flooding the system with even more fraudulent money. The larger the past credit expansion has been, the larger the looming depression, the bigger the inflationary tsunami must be.

Now you understand how come, in a few years, the billion has become the new million, and the trillion is the new billion. We just added three zeroes to the words we usually used. We are now speaking of the next trillionaires.

About that word, “trillionaire” (which spell checks haven’t been updated with yet), and to put it in perspective: the new Gotthard Base Tunnel, the world’s longest railway and deepest traffic tunnel, 57 kilometers under the Alps, which took 20 years to build, for which 28,200,000 tonnes of rock were excavated (5 great pyramids), cost US $10 billion in total.

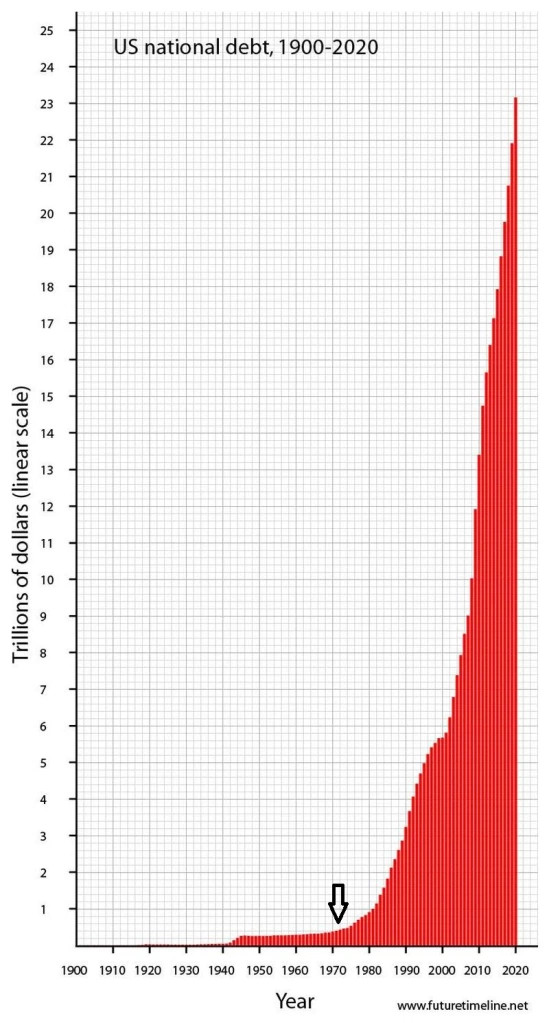

So one trillion is like digging 100 tunnels. Apple Corporation’s market capitalization reached 2.3 trillions recently; that’s 230 tunnels, or one tunnel 13,000 kilometers long. That’s more than the diameter of the Earth. Total US debt, at 27 trillion, is 2700 tunnels; or one tunnel 154,000 kilometers long. Twelve times the diameter of Earth.

It’s absurd. It doesn’t mean anything. It’s a complete farce.

Will we be speaking of quadrillionaires before confidence in the money is lost? We don’t think so. We think central planners are soon pulling the plug.

Coming Meltdown

It’s one thing to understand the nature and history of money, and thus to know how credit and paper currencies always and necessarily end. It’s another entirely to predict when they end. As Keynes correctly stated, the markets can remain irrational longer than we can remain solvent.

So what makes us believe a monetary catastrophe is indeed on the horizon? To be fair, people have been predicting the US dollar’s demise since at least the 1960s. There were also legitimate reasons to believe in 2008 that hyperinflation was imminent; and yet here we are, 12 years later, speaking about trillionaires.

First, we need to admit the central planners know what they are doing. They control the “markets” (and public perception) to a large extent; moreover, none of what we have written in this post so far is news to them. The public may have been made to forget that gold is money, but they certainly haven’t. They know the precious metal is their fiat currencies’ main competitor, and they have been actively managing (read: manipulating) its price for a long time with quite some success.

Second, we deduce the monetary system will collapse when the chief parasites decide it should collapse. They will be the ones pulling the plug. To be sure, they can’t sustain the game of musical chairs forever, even if they are able to do so for prolonged periods. But they are very likely to anticipate any organic collapse with a controlled one, as that gives them a better ability to shape the outcome.

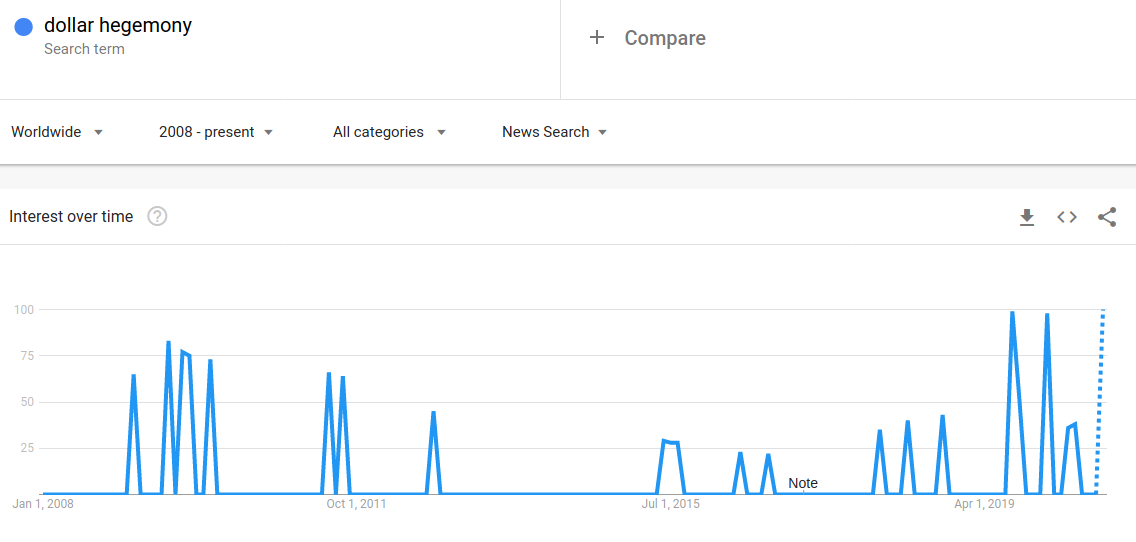

Third, we conclude that in order to predict the timing of such a controlled demolition, we need to look for signs other than merely the amount of debt or the paper price of gold. We need to look at the way the central planners are actively influencing the global common knowledge (what people know that other people know).

In that last regard, the signs are ominous; indeed there are not many things Donald Trump and his alleged opponents in the mainstream media agree on; one of those very rare things, and that is totally new, is that the dollar’s reserve status is bad for the US.

Both sides of the dialectic are relying on different rationales, but their conclusion is the same. Trump is more generally speaking of abandoning the postwar “US-centric” model, while overtly leveraging the American currency in a scripted trade and economic war with China (by favoring policies to devalue the dollar).

Legacy propaganda outlets are being even more explicit:

- On November 5, 2019, The Washington Post wrote a piece (archive) called “Why It’s So Hard to Overthrow the Mighty U.S. Dollar”. In it they ask questions like “Why are some people fed up with the dollar?”, and while denying anything could dethrone it in the short term, they do explain how it’s under threat, and that “Bank of England Governor Mark Carney says it would be a mistake to switch one dominant currency for another; he advocates a global digital currency to supersede the dollar.”

- On January 18th, 2020, The Economist published a paper (archive) titled “America’s aggressive use of sanctions endangers the dollar’s reign”. In it, we read that “Mr Trump has exposed China’s profound vulnerability to the dollar-centric financial system” and that “the new age of international monetary experimentation features the de-dollarisation of assets, trade workarounds using local currencies and swaps, and new bank-to-bank payment mechanisms and digital currencies.”

- On July 16, 2020, CNN came out with an analysis (archive) titled “The world loves the US dollar. Trump and the pandemic could change that”. The silver lining is clear: “If Trump wins a second term, Nomura thinks an ongoing push toward deglobalization could undermine the US dollar and encourage greater use of China’s yuan, or renminbi, to settle trades.” The rationale is that “foreign demand for dollars could decline if the country was no longer seen as guaranteeing the security of its allies, leading them to hold more of their reserves in euros, yen and renminbi.”

- On July 28, 2020, Foreign Affairs (archive) peremptorily states “It Is Time to Abandon Dollar Hegemony”. It adds that “issuing the world’s reserve currency comes at too high a price” and that giving up on the idea “could benefit the United States and ultimately, the rest of the world”.

- On the same day, Bloomberg published an article (archive) stating “Goldman [Sachs] Warns Dollar’s Role as World Reserve Currency Is at Risk” in which they quote the bank as saying that “The U.S. dollar’s reign as the world’s reserve currency is coming under threat”, that “Real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge”, and that this “comes amid renewed calls for the dollar’s demise following a game-changing rescue package from the European Union deal”.

- On August 25, 2020, Nouriel Roubini via The Guardian, while denying the dollar’s preeminence is under short-term threat, still writes (archive) that “another risk is the loss of US geopolitical hegemony, which is one of the main reasons why so many countries use the dollar in the first place” and that “weaponisation of the dollar via trade, financial and technology sanctions could hasten the transition.”

It is worth reading these articles in full, not to expect truthful insights, but rather to analyze how the common knowledge is being shaped; and of course, there are many more. It is especially interesting to notice how the narrative has preceded the coronacircus, and in a seemingly natural way is being carried over.

Here is another interesting omen: when a very left-wing outlet such as Counterpunch publishes in February 2019 an article such as this one (archive), titled “Trump’s Brilliant Strategy to Dismember U.S. Dollar Hegemony”, we should pay attention. It means thesis and anti-thesis are merging into a synthesis.

But who would have thought that Donald Trump would become the catalytic agent? No left-wing party, no socialist, anarchist or foreign nationalist leader anywhere in the world could have achieved what he is doing to break up the American Empire.

The Deep State is reacting with shock at how this right-wing real estate grifter has been able to drive other countries to defend themselves by dismantling the U.S.-centered world order.

[…]

The end of our monetary imperialism, about which I first wrote in 1972 in Super Imperialism, stuns even an informed observer like me. It took a colossal level of arrogance, short-sightedness and lawlessness to hasten its decline — something that only crazed Neocons like John Bolton, Elliott Abrams and Mike Pompeo could deliver for Donald Trump.

Conclusion

This article tried to address a complex topic in the minimum amount of words. We have omitted many aspects:

- We could have mentioned how the oil-exchange standard is obsolete now that the US is a net oil producer;

- We could have written at length about the emergence of China and the “new multipolar world order” being promoted by globalist institutions;

- We could have pointed out China issued this year its first dollar-denominated bond (effectively betting against US currency);

- We could have remarked that the recent multi-trillion wave of new money, ostensibly issued because of the coronacircus, was actually made necessary by the Fed trying to raise rates and cracks beginning to form in the repo market last year;

- We could have devised a chapter on the tensions (and supply concerns) that emerged this year in the gold market;

- We could have noticed how doubt is being seeded by the MSM regarding Fort Knox gold, or that the Wall Street Journal shockingly referred to the metal this year as “unaffordium” and “unobtanium” (a few years after calling it a pet rock).

- We could have highlighted the significant themes that emerged at the latest Jackson Hole conference;

- We could have repeated some of the points we already made in our post about negative oil prices;

- And of course, we could have described how all of this is congruent with the cashless society the WEF and its “Great Reset” seem to have in store.

But all of this would have been only of secondary importance.

The key takeaway is this: everything points to the fact Donald Trump has been designated as the president who will oversee the end of the US empire, and therefore of the US dollar’s global reserve status.

Using him as cover, the central planners are about to pull the plug on the postwar monetary system.

We already predicted as much in our psychological warfare post. We said he would convene a monetary conference, presented as a kind of new Plaza or Louvre Accord, and that he would be cheered by his base for “negotiating” a severe dollar depreciation versus the Yuan Renminbi. More than ever, we expect something like this will indeed happen some time during his second term.

The problem will all this, of course, is that the USA has been living on borrowed time. An end to its extraordinary monetary privilege cannot be anything but abrupt; it will translate into a significant shock for the US (and world) economy, and a substantially decreased standard of living for Americans. This involves a potential for great violence, which the union itself might not survive.

It will also mean a crisis in gold, the ultimate extinguisher of debt; that crisis would manifest as a split between the paper and physical prices of bullion (or London, Chicago and Shanghai prices).

Americans would be well advised to change their savings into precious metals, and keep them as far away from the government and the banking system as possible.